Sri Lanka’s economy likely fell deeper into recession, as tight monetary policy and Asia’s fastest inflation further dampened the nation’s economic health, Bloomberg reported on Thursday (15).

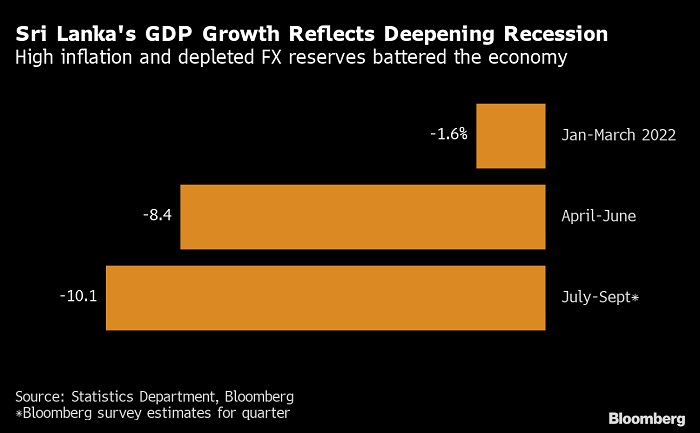

According to a Bloomberg survey of economists, the gross domestic product probably contracted about 10% between July and September compared to the same period last year.

That’s the slowest reading in two years and compares with an 8.4% contraction in the April to June period.

“Demand remained sluggish as high inflation and weak confidence kept consumption under pressure,” said Ankur Shukla of Bloomberg Economics.

Sri Lanka, which is weathering its worst economic meltdown in decades, tried to forestall further deterioration in the quarter, even as protests and fuel shortages ground activity to a halt. Authorities pledged to implement strong fiscal and reform measures to lock down an initial bailout deal from the International Monetary Fund.

The IMF agreement and restructuring talks with other creditors have stoked optimism that Sri Lanka is turning a corner. The South Asian nation is pursuing pacts with commercial and bilateral lenders to meet conditions for the IMF program, which could begin in January if debt assurances from China come through this month.

Central Bank of Sri Lanka Governor Nandalal Weerasinghe said last month that the bailout will help the country replenish depleted foreign exchange reserves and stabilize finances.

“Once the IMF program is finalized, the risk premium on Sri Lanka will go down, bringing down interest rates with it,” said Sanjeewa Fernando, strategist at CT CLSA Securities Pvt. Further inflows will also have positive bearings on the currency, he added.

The Sri Lankan rupee has stabilized since May, but it’s still down 80% this year against the dollar. Stocks declined 28% in 2022 and the nation’s 7.55% 2030 dollar bond is indicated at about 29 cents on the dollar. That compares to 51 cents at the start of the year.

In a sign of some respite, consumer price gains have started trending downward amid tight policy and falling global commodity costs. Prices hit a record 69.8% between July and September, forcing the central bank to raise borrowing costs to 15.5%. Since then, Sri Lanka’s inflation has slowed and is expected to drop next year. (NewsWire)