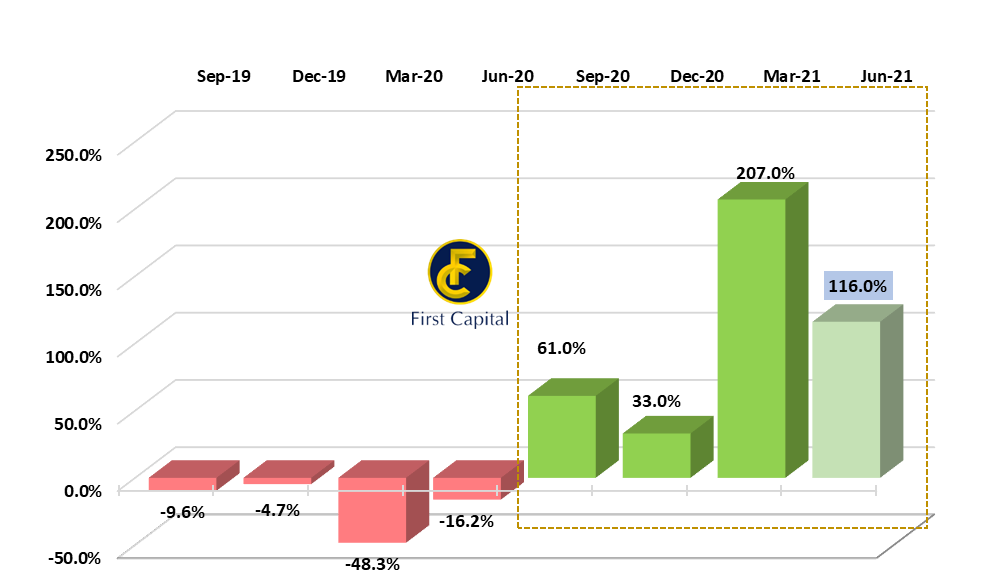

Jun 2021 quarter earnings surged by 116%YoY to LKR 76.3Bn for 262 companies:

- Capital Goods (255%YoY),

- Banks (65%YoY), Food, Beverage & Tobacco (94%YoY),

- Consumer Durable & Apparel (1869%YoY),

- Transportation (259%YoY)

- Telecommunication (68%YoY) sectors.However, sluggish performance was witnessed in Diversified Financials (-50%YoY) and Insurance sector (-15%YoY) earnings. Most of the listed sectors saw a surge in profitability, due to lower base effect in the previous year equivalent quarter amidst the negative impact by the initial COVID-19 triggered lockdowns and also due to the rebound in economy in Jun 2021 quarter as normalcy recovers.

Multiple sectors post impressive earnings: In Jun 2021 quarter, Capital Goods, Banks, Food, Beverage & Tobacco, Consumer Durable & Apparel, Transportation sector and Telecommunication sectors witnessed exceptional results. Capital Goods recorded an impressive growth of 255%YoY owing to the rebound in performance in many counters.

JKH witnessed a surge in earnings by LKR 3.2Bn led by all segments except for Consumer Foods while the handover process of the residential apartment units at ‘Cinnamon Life’ commenced, causing the recognition of revenue and profits from sales for the first time in the project resulting in property segment EBITDA increasing by 1978%YoY.

HAYL’s profitability rose by LKR 2.5Bn mainly led by the improvement in revenue by 46.4%YoY across strong performance in most of the sectors and reduction in net finance cost by 21.7%YoY to LKR 2.4Bn.

In the Banking sector, three largest banks COMB, HNB and SAMP registered enhanced profitability due to improved Net Interest Income despite increase in impairment provision and conservative loan book growth.

Food, Beverage & Tobacco earnings recorded an increase led by the rebound in consumer recovery while Consumer Durable & Apparel sector profitability surge was led by GREG due to the capital gain from the sale of South Asia Textiles.

Transportation sector earnings improved dominated by EXPO while Telecommunication sector earnings rose with the strong performance in DIAL and SLTL due to robust performance in data segment with the working from home arrangements.

Diversified Financials and Insurance sectors illustrate lackluster performance: Diversified Financials sector earnings recorded a decline of 50%YoY led by LOLC due to the higher base effect in 1QFY21 as a result of gain of LKR 42.9Bn with the disposal of 49% stake in PRASAC Microfinance in Cambodia.

Moreover, insurance sector earnings declined by 15%YoY led by higher provision to Life insurance fund amidst prevailed lower interest rate environment.

Quarterly Results Review: https://firstcapital.lk/storage/2021/09/Quarterly-Results-Review-Jun-2021.pdf

Results Update Sector Summary: https://firstcapital.lk/storage/2021/09/Results-Update-Sector-Summary-Jun-2021.pdf

Results Update All Companies: https://firstcapital.lk/storage/2021/09/Results-Update-for-all-companies-Jun-2021.pdf