The Central Bank of Sri Lanka has revealed details of the conversion of outstanding credits of the bank to the Government into negotiable debt instruments with specified maturities under the Domestic Debt Optimization Programme (DDO).

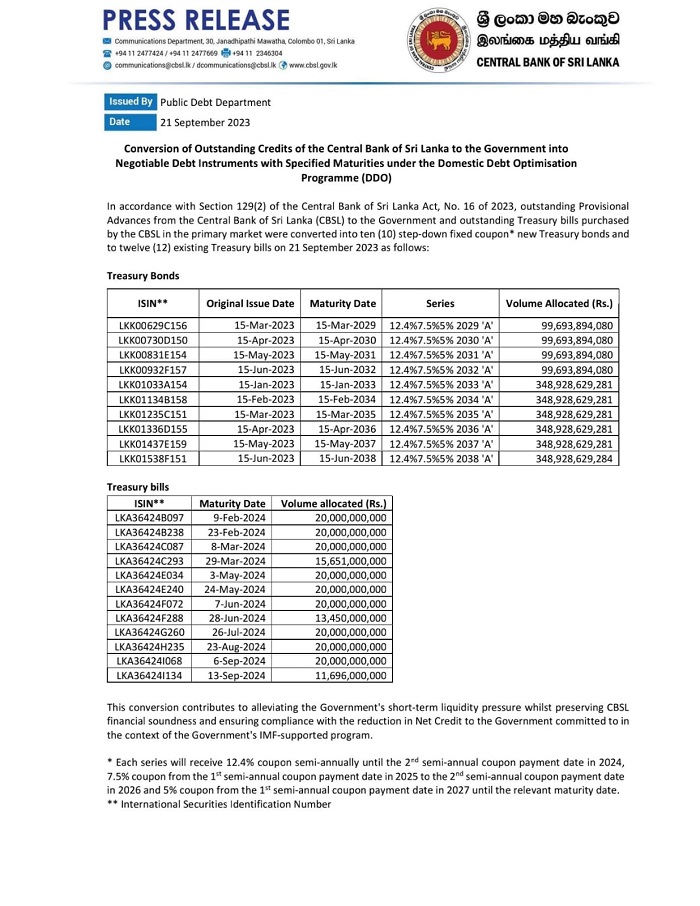

Issuing a statement, the CBSL stated that outstanding Provisional Advances from the bank to the Government and outstanding Treasury bills purchased by the CBSL in the primary market were converted into ten (10) step-down fixed coupon* new Treasury bonds and to twelve (12) existing Treasury bills.

The bank further stated this was carried out in accordance with Section 129(2) of the Central Bank of Sri Lanka Act, No. 16 of 2023.

This conversion contributes to alleviating the Government’s short-term liquidity pressure whilst preserving the CBSL’s financial soundness and ensuring compliance with the reduction in Net Credit to the Government committed to in the context of the Government’s IMF-supported program.

Each series will receive 12.4% coupon semi-annually until the 2nd semi-annual coupon payment date in 2024, 7.5% coupon from the 1st semi-annual coupon payment date in 2025 to the 2nd semi-annual coupon payment date in 2026 and 5% coupon from the 1st semi-annual coupon payment date in 2027 until the relevant maturity date.

The conversion as of September 21, 2023 is as follows: