SriLankan Airlines and the Government of Sri Lanka have announced the unsuccessful conclusion of initial debt restructuring talks with a group representing over 50% of the airline’s US$175 million guaranteed bonds due in June 2024.

The restricted discussions, held between July 28 and August 1, included the company, the government, and six members of the Ad Hoc Group of Bondholders. Despite what both sides described as “constructive” talks, no agreement was reached on restructuring terms.

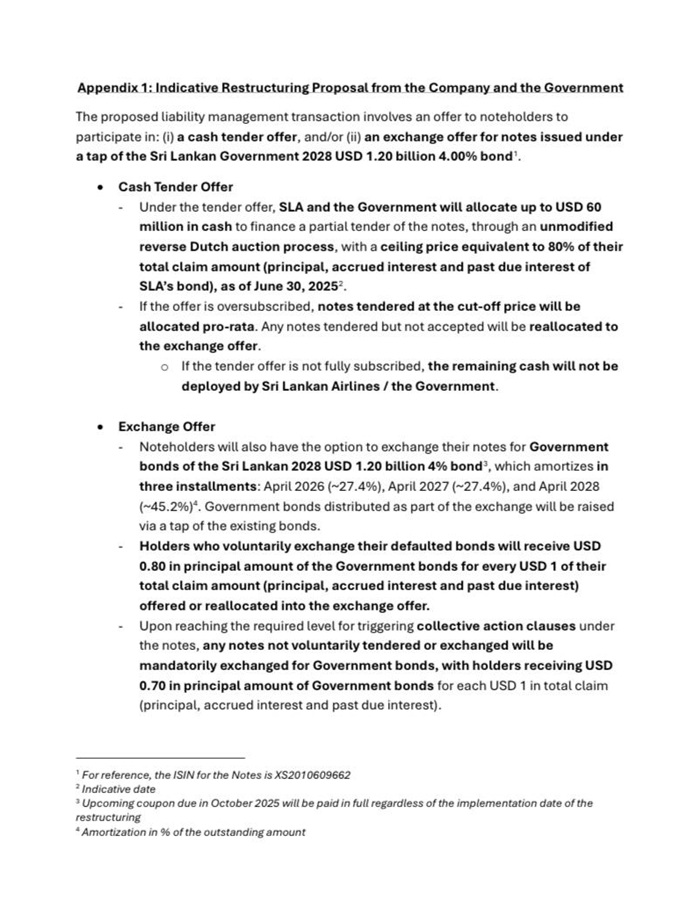

SriLankan Airlines presented a proposal offering bondholders a combination of cash—up to US$60 million via a tender offer—and an exchange into government bonds maturing in 2028. In return, holders would accept a haircut, receiving 80 cents on the dollar for voluntarily restructured bonds or 70 cents under mandatory terms triggered by collective action clauses.

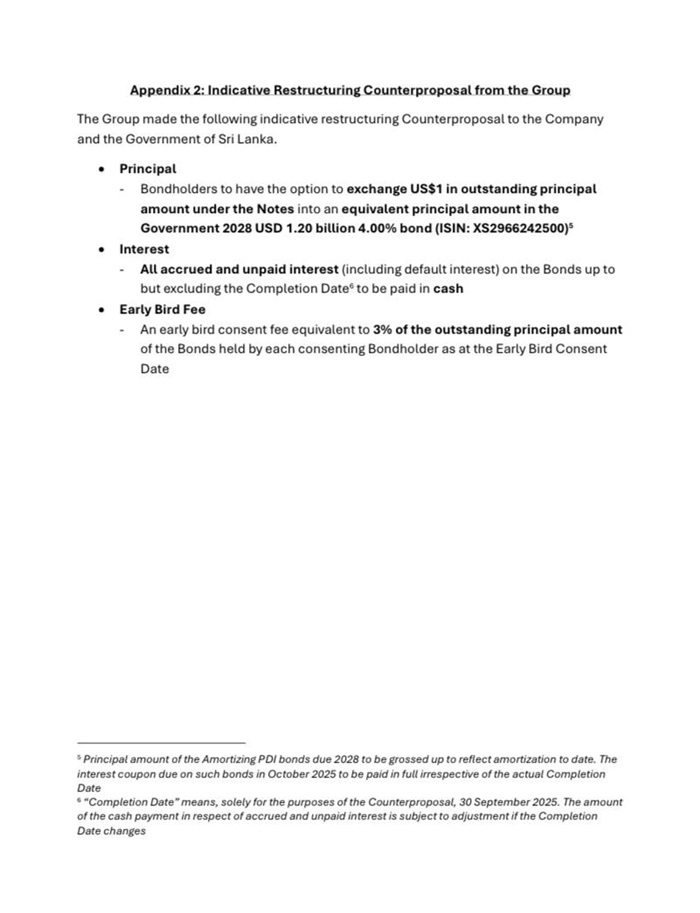

The bondholder group countered with a proposal seeking full principal recovery via an exchange into 2028 sovereign bonds, payment of all accrued and unpaid interest in cash, and an early bird consent fee of 3% of the principal.

After reviewing the counterproposal, the airline and the government said the terms were “far from what is expected” and not viable within Sri Lanka’s IMF-backed debt sustainability framework. Consequently, the parties agreed to terminate the discussions.

The government noted that over 98% of eligible public debt has already been addressed through prior agreements, of which 92% has been implemented. It reiterated its commitment to equal treatment among all creditors and emphasized that SriLankan Airlines’ bonds are part of the broader restructuring perimeter.

The details of the discussion were released in a filing on the Singapore Stock Exchange (https://www.sgx.com). (Newswire)