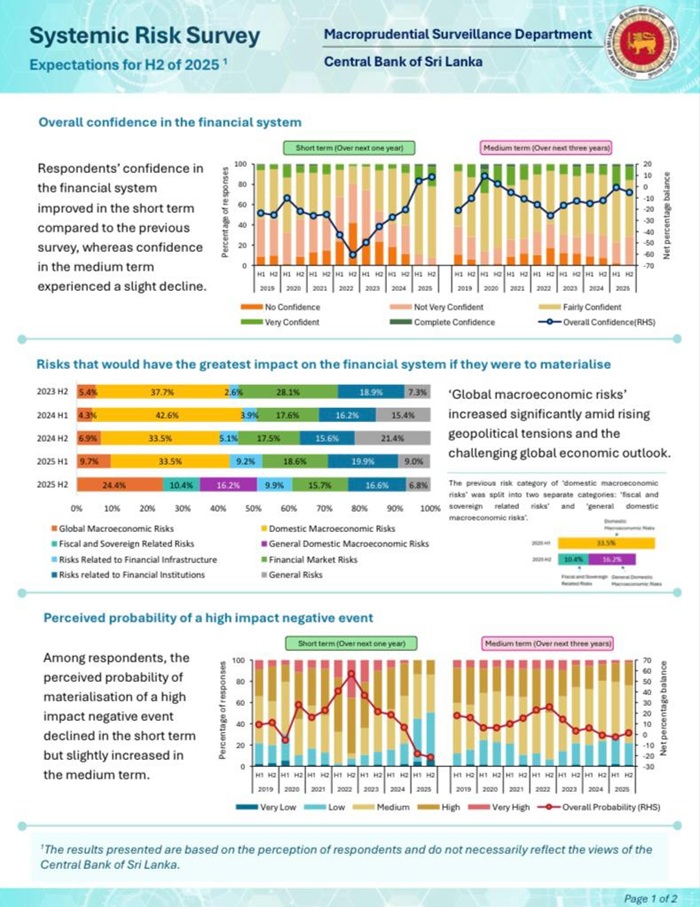

The Central Bank of Sri Lanka says respondents’ confidence in the financial system improved in the short term compared to the previous Systemic Risk Survey, whereas confidence in the medium term experienced a slight decline.

Releasing key findings of the Systemic Risk Survey conducted for the second half of 2025, the Central Bank said global macroeconomic risks increased significantly amid rising geopolitical tensions and the challenging global economic outlook.

Among respondents, the perceived probability of materialisation of a high-impact negative event declined in the short term but slightly increased in the medium term, it added.

The latest Systemic Risk Survey (SRS) summarises financial market participants’ overall confidence in the financial system, the sources of perceived risks and the likelihood of such risks.

The results of the publication are based on the perception of respondents and do not reflect the views of CBSL. The SRS quantifies and tracks market participants’ views on risks and their confidence in the Sri Lankan financial system.

The sampling frame of the survey comprises the risk officers of licensed banks, licensed finance companies, a specialised leasing company, insurance companies, unit-trust managing companies, margin providers & underwriters, stock brokerage firms, licensed microfinance companies and rating agencies.

The semi-annual publications presenting the key findings of the 2025 SRSs are available on the CBSL website and can be accessed at: https://www.cbsl.gov.lk/en/publications/other-publications/systemic-risk-survey/ (Newswire)