The special audit report on Sri Lanka’s controversial e-Visa contract has revealed that service providers linked to the project failed to remit more than USD 1.4 million in due taxes to the Inland Revenue Department.

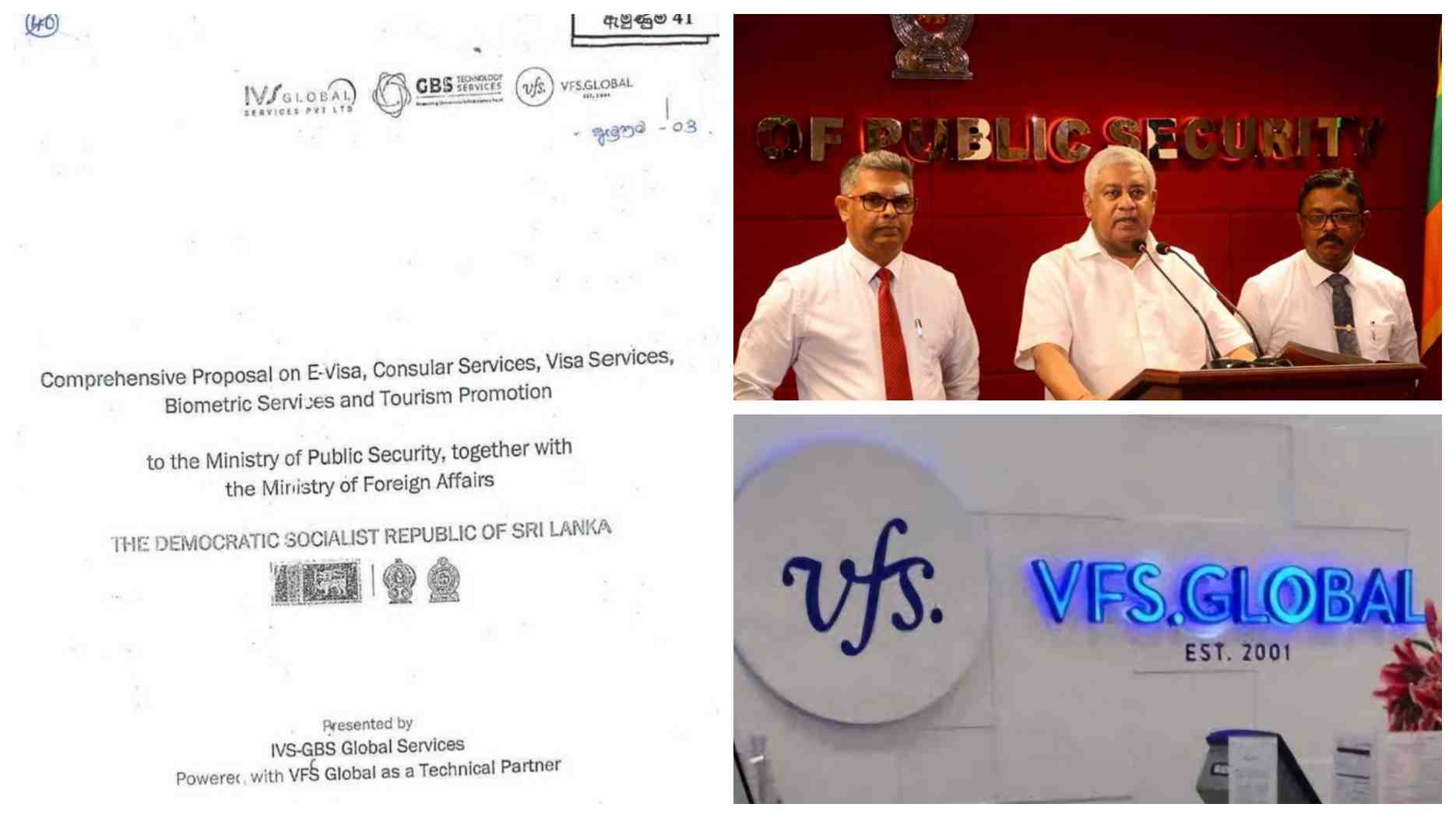

According to the report, GBS Technology Services & IVS Global-FZCO, operating under VFS VF Worldwide Holdings Ltd, had collected both the 2.5 percent Social Security Contribution Levy and 18 percent Value Added Tax from visa applicants between April and August 2024.

However, the amounts — estimated at USD 172,970 in SSCL and USD 1,245,390 in VAT — were not paid to the government, resulting in a total tax loss of USD 1,418,360.

The report notes that the companies handled 373,991 visa applications during this period, generating at least USD 6.9 million in service-fee revenue.

It further found that the firms earned an additional USD 1.8 million from visa-fee-waiver countries where tourists were exempt from paying visa fees but were still charged service fees — revenue that would not have been generated under the previous Electronic Travel Authorization (ETA) system.

In addition to the visa fee charged by the Department, the audit highlighted that all visa applicants — including those eligible for exemptions — were required to pay a service fee of USD 18.50 under the new system. Under the previous ETA arrangement, no such service fee was applied, and the approved improvement proposal had suggested a nominal charge of only USD 1. The audit questioned how the steep increase in service fees could be justified, especially for tourist and business visa categories meant to encourage arrivals.

The failure to remit taxes was among several irregularities identified in the special audit report, which pointed to major procedural lapses, revenue losses, and a lack of transparency in awarding and implementing the e-Visa project.

According to the report, the key irregularities include:

1. Unpaid Taxes Collected from Applicants

The audit found that GBS Technology Services & IVS Global-FZCO and VFS VF Worldwide Holdings Ltd had collected but not remitted taxes worth USD 1.418 million (USD 172,970 in SSCL + USD 1,245,390 in VAT) from visa applicants between April and August 2024.

These funds were due to the Inland Revenue Department but were instead retained by the service providers.

2. Service fees collected from Fee-Waiver Countries

The report shows the companies earned about USD 1.82 million by charging service fees on 98,401 visa-exempt applications, even though those applicants were supposed to obtain visas free of charge under the government’s tourism promotion scheme.

3. Excessive and Unjustified Service Fees

All visa applicants — including those eligible for free visas — were charged USD 18.50 per application, whereas the earlier ETA system charged only USD 1.

The audit questions how this steep increase could be justified, particularly for tourist and business visa categories.

4. No Competitive Bidding or Procurement Process

The Committee on Public Finance and the audit both note that VFS Global and its affiliates were selected without calling for official bids, violating government procurement rules and depriving the Department of Immigration and Emigration of a chance to obtain competitive rates.

5. Payments Routed to Foreign Accounts / Lack of Transparency

Visa revenues collected between April and August 2024 were remitted directly to foreign bank accounts of the private operators, not through government-controlled channels.

Because of this, the Department had no accurate records of how much money was collected, making verification of revenue impossible. (Newswire)