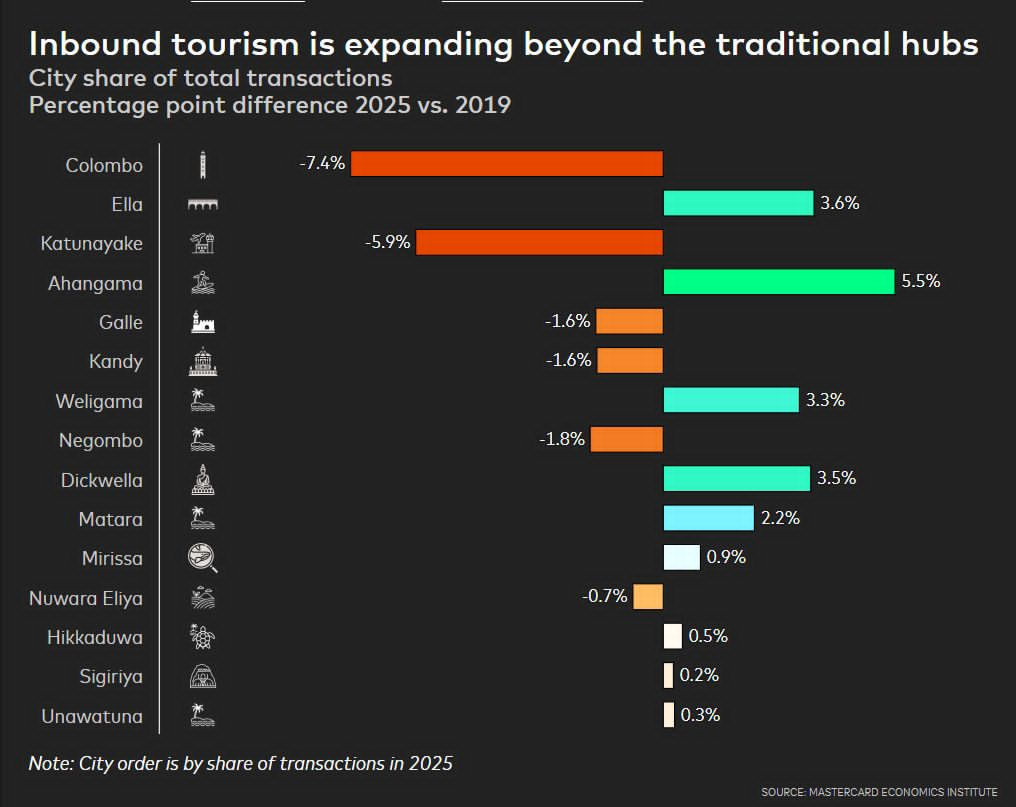

Sri Lanka’s inbound tourism is undergoing a structural shift, with visitor spending moving beyond traditional urban centres toward emerging destinations, according to the Mastercard Economics Institute’s Economic Outlook 2026.

Commenting on the findings, Sandun Hapugoda, Country Manager for Sri Lanka and Maldives at Mastercard, said the data shows a clear evolution in travel patterns when comparing 2025 with pre-pandemic 2019 levels.

“Colombo continues to lead tourism-related transactions, accounting for nearly a quarter of total spend, but its share has moderated. This reflects diversification rather than a decline,” Hapugoda said, noting that Colombo still represents 24.77% of total transactions despite a 7.44 percentage point drop in share.

He said inland and coastal destinations are increasingly benefiting from changing traveller preferences, with Ella emerging as a key inland tourism hub. Ella accounts for 7.48% of total transactions, recording a 3.59 percentage point increase over the period.

“The most compelling story is unfolding along the Southern Belt,” Hapugoda said, pointing to strong and sustained growth in destinations such as Ahangama, Weligama, Dickwella, Matara and Mirissa. He said the trend reflects a shift towards experiential travel and longer stays.

Ahangama recorded a 5.54 percentage point increase, contributing 6.11% of total transactions, while Weligama followed with a 3.25 percentage point increase and a 4.91% share. Dickwella grew by 3.51 percentage points to account for 3.86%, Matara by 2.18 percentage points to 3.17%, and Mirissa by 0.88 percentage points, now contributing just over 3% of transactions.

“These patterns highlight how tourism growth in Sri Lanka is becoming more geographically distributed, inclusive and locally impactful,” Hapugoda said.

Traditional tourism centres such as Kandy and Galle recorded modest declines of around 1.6 percentage points each, while continuing to contribute significantly, accounting for 5.96% and 5.37% of total transactions respectively.

The Mastercard Economics Institute projects Sri Lanka’s GDP growth to moderate to 3.7% in 2026 from an estimated 4.4% in 2025. However, Hapugoda said the broader economic momentum remains resilient.

“Growth continues to be supported by private consumption, investment, low inflation, strong remittance inflows, rising tourism receipts and accommodative monetary policy,” he said. (Newswire)