Sri Lanka’s external sector showed mixed performance in November 2025, with the current account returning to a surplus after recording deficits in the previous two months, according to data released by the Central Bank of Sri Lanka.

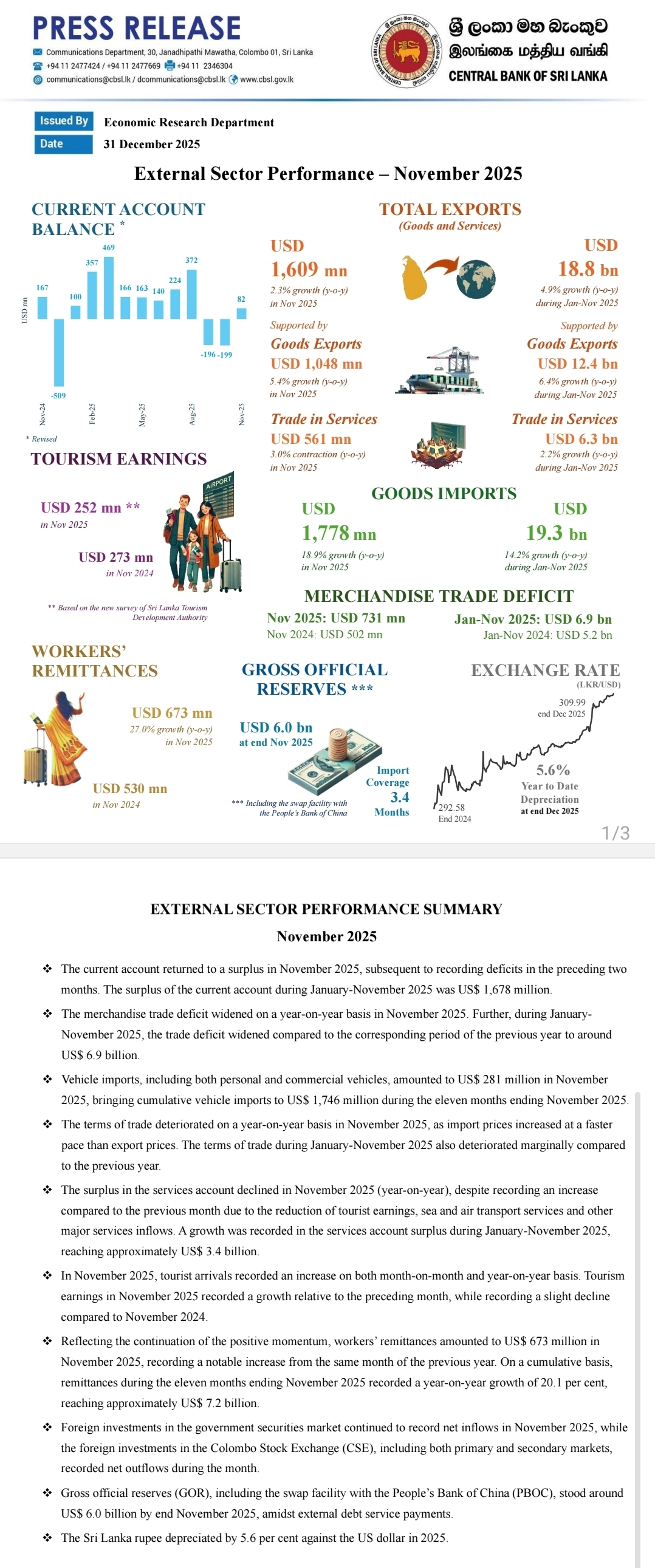

The central bank said the current account posted a surplus in November, while the cumulative surplus for the January–November 2025 period stood at US$ 1.68 billion.

However, pressures persisted on the trade account, as the merchandise trade deficit widened year-on-year in November. For the first eleven months of 2025, the trade deficit expanded to around US$ 6.9 billion, compared to the corresponding period last year.

Vehicle imports continued to weigh on the trade balance, with imports of personal and commercial vehicles amounting to US$ 281 million in November. Cumulative vehicle imports during the eleven months ending November rose to US$ 1.75 billion.

The terms of trade deteriorated on a year-on-year basis in November, as import prices increased faster than export prices. A marginal deterioration was also recorded for the January–November period compared to last year.

The surplus in the services account declined on a year-on-year basis in November, despite an improvement compared to October, reflecting lower tourist earnings as well as reduced inflows from sea and air transport services. On a cumulative basis, the services account surplus grew to approximately US$ 3.4 billion during the first eleven months of 2025.

Tourism indicators remained broadly positive, with tourist arrivals increasing both month-on-month and year-on-year in November. Tourism earnings rose compared to the previous month, though they recorded a slight decline compared to November 2024.

Workers’ remittances maintained strong momentum, reaching US$ 673 million in November, a notable increase from the same month last year. Cumulative remittances for the January–November period grew by 20.1 per cent year-on-year to about US$ 7.2 billion.

Foreign investment flows showed divergence, with net inflows continuing into the government securities market in November, while the Colombo Stock Exchange recorded net foreign outflows across both primary and secondary markets.

Gross official reserves, including the swap facility with the People’s Bank of China, stood at around US$ 6.0 billion by end-November, despite ongoing external debt service payments. Meanwhile, the Sri Lankan rupee depreciated by 5.6 per cent against the US dollar during 2025. (Newswire)