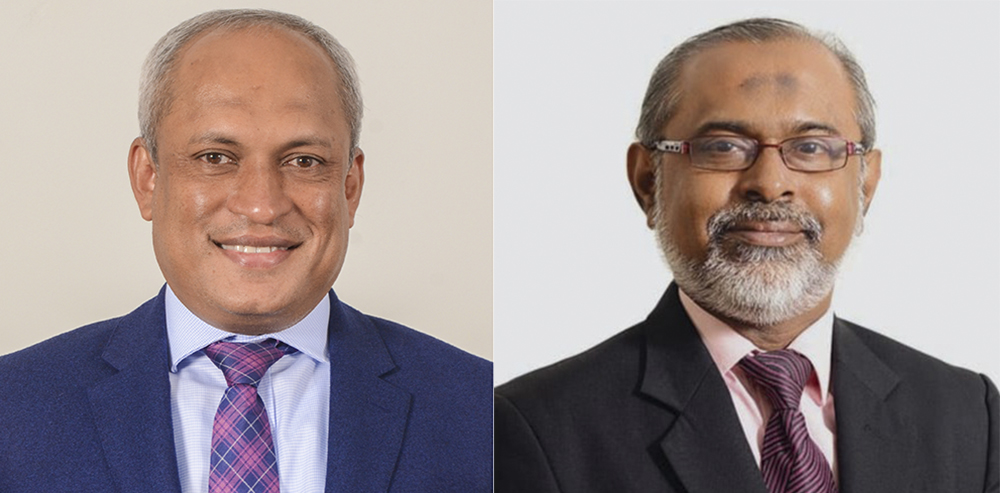

WEBXPAY, Sri Lanka’s foremost digital-finance innovator, today announced the appointment of Mr. A. A. M. Thassim, former Deputy Governor of the Central Bank of Sri Lanka (CBSL) as a Non-Executive Director. His arrival strengthens WEBXPAY’s governance and regulatory rigour as the company accelerates its evolution from payment gateway pioneer to a full-scale financial-technology ecosystem.

Executive Chairman Thilak Piyadigama said, “We are thrilled to welcome Mr. Thassim to the Board. His unmatched regulatory insight and deep governance expertise align perfectly with our mission to scale responsibly while delivering lasting value to merchants, consumers, and the public sector.”

Mr. Thassim brings more than three decades of leadership at the CBSL, where he oversaw bank supervision, foreign-reserves management, and the modernisation of national payment infrastructure. As Deputy Governor he headed the Financial System Stability Cluster, steering landmark initiatives such as Basel III implementation, IFRS 9 adoption, and the country-wide rollout of the Cheque Imaging and Truncation System. His influence extends beyond the central bank: he has chaired the Credit Information Bureau and the Institute of Bankers of Sri Lanka and served as the Secretary to the Governing Board, Monetary Policy Board, Audit Committee, Board Risk Oversight Committee, Ethics Committee and Financial Sector Crisis Management Committee. In addition, he was also a board member of the Sri Lanka Export Credit Insurance Corporation and LankaClear (Pvt) Ltd., which is the national clearing house of the country and currently known as LankaPay.

An Associate Member of the Chartered Institute of Management Accountants (UK), Mr. Thassim also holds an MBA from the Postgraduate Institute of Management at the University of Sri Jayewardenepura. He completed executive programmes in Gold Reserves Management at the Haas School of Business, University of California, Berkeley, and in public-sector leadership at Harvard Kennedy School.

Founded in 2015 to simplify digital payments for small businesses, WEBXPAY now serves more than 5,000 merchants, partners with eight local banks, and offers next day (T+1) settlements. Its product portfolio ranges from the enterprise-grade e-commerce API suite XGATEWAY and the in-store card-and-QR acceptance solutions XPOS and XQR to the flexible instalment platform XSPLIT and the field-collection tool XCOLLECTOR. The platform is fully ISO 27001 and PCI DSS certified, underscoring its commitment to security and compliance.

WEBXPAY is investing heavily in AI-driven onboarding, supply-chain finance, lending, and advanced analytics initiatives that will benefit substantially from Mr. Thassim’s strategic guidance.

“This appointment underscores our core values of integrity, stability, and measurable progress,” Mr. Piyadigama added. “My fellow board members, Fazal Mohomed, Tamir Illyas, Sarah Illyas, Anuradha Bandara, and Nayana Serasinghe, and I are truly honored and privileged to welcome Mr. Thassim to the Board of WEBXPAY. With his guidance, we are poised to dismantle the remaining barriers to digital finance and unlock wealth for all.”