KPMG Sri Lanka’s analysis of the 2026 Budget highlights several significant indirect tax proposals aimed at broadening the tax base and aligning local tax systems with international standards.

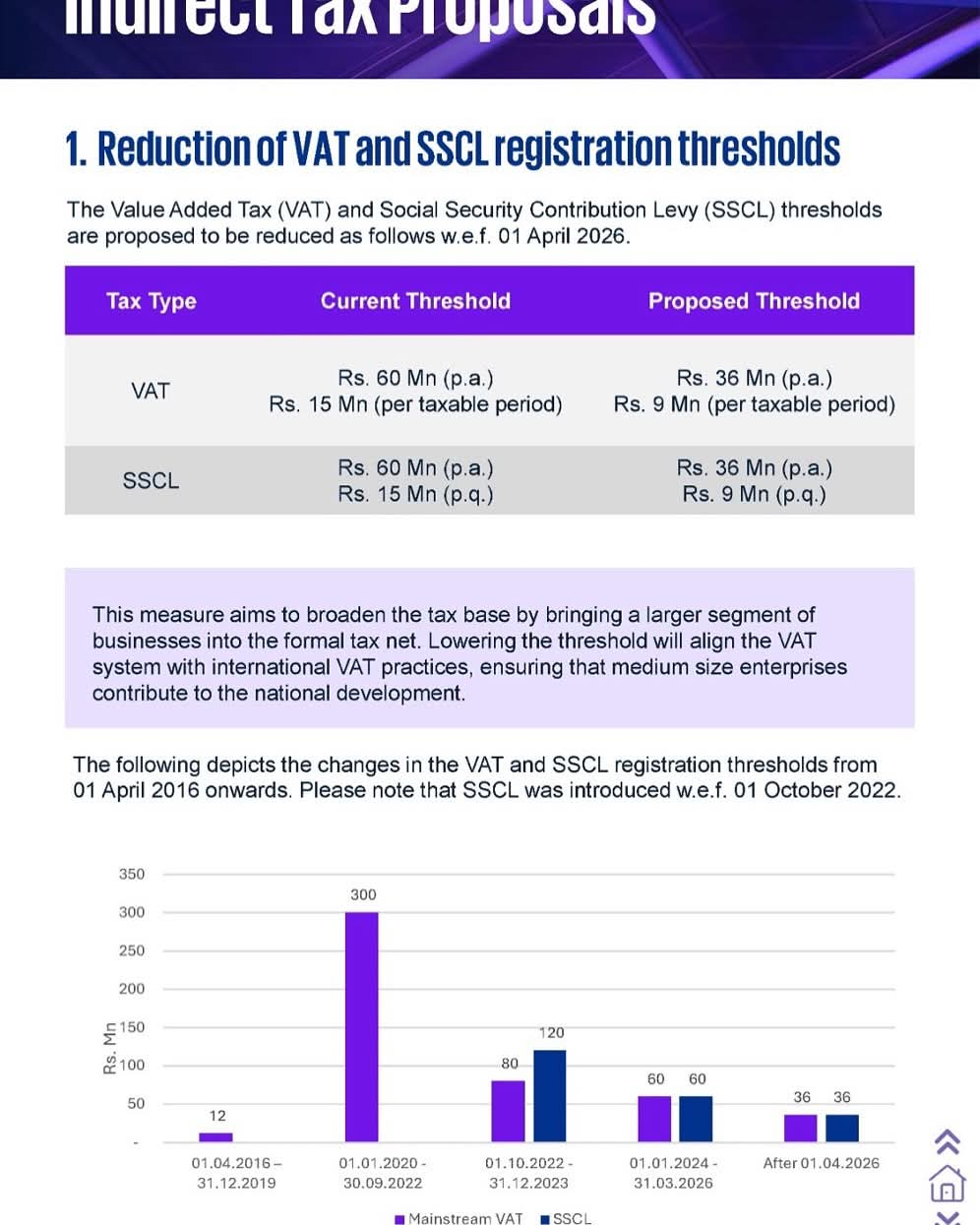

The proposals include reducing the Value Added Tax (VAT) and Social Security Contribution Levy (SSCL) registration thresholds from Rs. 60 million to Rs. 36 million per annum, effective April 1, 2026. The quarterly threshold will drop from Rs. 15 million to Rs. 9 million. According to KPMG, this move is designed to bring more medium-sized businesses into the formal tax net.

The Budget also proposes imposing VAT and SSCL on imported coconut and palm oil, replacing the existing Special Commodity Levy.

VAT will be levied at 18 percent and SSCL at 2.5 percent, aligning taxes on imported and locally produced oils.

Another proposal seeks to impose VAT on imported fabric while abolishing the Rs. 100-per-kilogram CESS. KPMG noted that this measure ensures parity between imported and locally manufactured textiles under a uniform tax framework.

In addition, SSCL will apply to the sale, importation, and manufacture of motor vehicles from April 2026, streamlining revenue collection. However, KPMG observed that clarity is needed on how this will interact with existing excise duties on vehicles. (Newswire)