The Walt Disney Company and billionaire Mukesh Ambani’s Reliance Industries have merged their massive Indian TV and streaming businesses, ending months of speculation.

As per the agreement, Reliance’s Viacom18 is merging with Disney’s Star India. The deal is estimated to be worth $8.5 billion on a ‘post-money basis,’ the companies said.

Reliance Industries will own 16.3% of the merged entity, Viacom18 will own 46.8% and Disney 36.8%.

The Reliance duo will invest $1.4 billion into the joint venture and Nita Ambani will serve as chair of the merged entity. Former Disney India chair Uday Shankar is set as vice chair and strategic advisor.

(Bodhi Tree, a company controlled by Shankar and James Murdoch, owns 15.97% of Viacom18. Paramount holds 13% of Viacom18.)

A combination of the two – which include rival streaming platforms, India’s leading pay-TV platform and over 100 linear TV channels – has the potential to substantially re-shape the Indian media and entertainment scene and command a 40% market share. “The JV will have over 750 million viewers across India and will also cater to the Indian diaspora across the world,” the companies said.

“The JV will also be granted exclusive rights to distribute Disney films and productions in India, with a license to more than 30,000 Disney content assets, providing a full suite of entertainment options for the Indian consumer,” they said.

A deal on that scale is also likely to attract regulatory attention. They said that they expect the deal to be completed by the fourth quarter of this year or the first quarter of 2025. In a statement, the companies said, “Disney may also contribute certain additional media assets to the JV, subject to regulatory and third-party approvals.”

“India is the world’s most populous market, and we are excited for the opportunities that this joint venture will provide to create long-term value for the company. Reliance has a deep understanding of the Indian market and consumer, and together we will create one of the country’s leading media companies, allowing us to better serve consumers with a broad portfolio of digital services and entertainment and sports content,” said Bob Iger, CEO of The Walt Disney Company.

“This is a landmark agreement that heralds a new era in the Indian entertainment industry. We have always respected Disney as the best media group globally and are very excited at forming this strategic joint venture that will help us pool our extensive resources, creative prowess, and market insights to deliver unparalleled content at affordable prices to audiences across the nation. We welcome Disney as a key partner of Reliance group,” said Mukesh D. Ambani, chair and MD of Reliance Industries.

Disney became one of the largest players in the Indian entertainment field when it bought 21st Century Fox. The former Murdoch family-led operation included the Star pay-TV platform and the wildly popular Hotstar streaming startup. Disney subsequently merged Hotstar into its own Disney+ platform to create a mass-market streamer with a low price point.

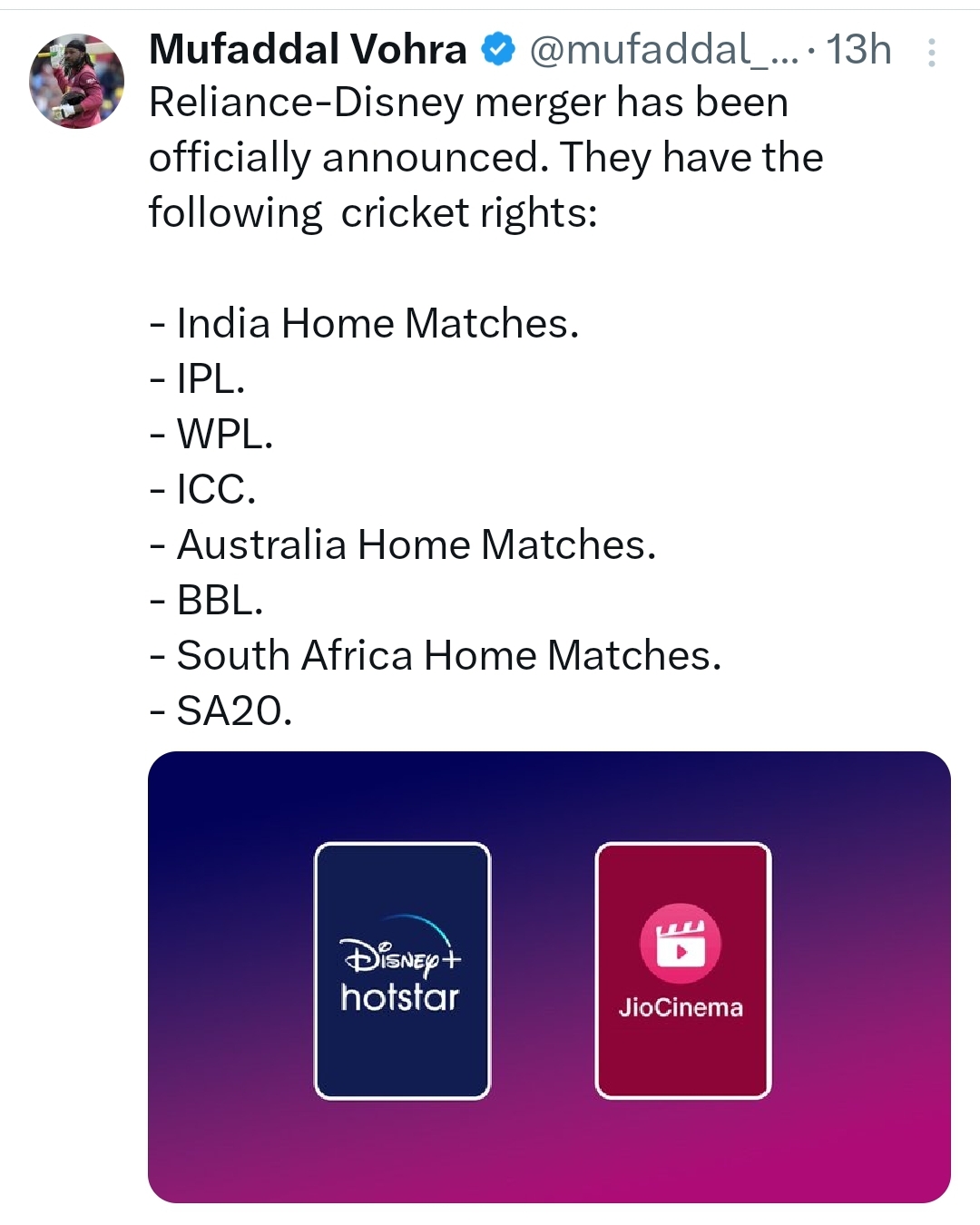

Disney’s dominance however has been challenged by the Ambani-controlled Viacom18 group and its suite of Jio-branded operations that stretch from mobile phones, to broadband internet and, latterly, streaming service JioCinema.

In what may have been a huge miscalculation in 2022, Disney failed to win the streaming rights for the 2023-2027 seasons of the Indian Premier League cricket tournament, which it had shown on Hotstar. Paying roughly $3 billion each, Jio took the streaming rights, while Disney secured only the pay-TV rights. And when Jio streamed the IPL free of charge in 2023 it was able to undercut Star and cause Disney+ Hotstar to lose tens of millions of users.

With Reliance Industries’ hugely deep pockets, Jio has already been able to profit from one aspect of Hollywood’s ongoing consolidation and the Wall Street imposed drive for financial rectitude. Early last year, Jio became the new streaming home in India for HBO, Max Original and Warner Bros content, effectively precluding the launch of HBO Max in India in the near to medium future. The HBO win was also a loss for Disney as the WBD content had previously been carried on Star TV.

The creation of this new Indian behemoth comes in the wake of Sony Group Corporation ending its more than two-year attempt to merge its TV and streaming businesses in India with local giant Zee Entertainment Enterprises Limited, in what would have been a $10 billion deal. (Variety)